Low-latency trading is often seen as complex and expensive, but NANOCONDA makes it simple, fast, and affordable. You get everything - software, API, hardware, and colocation - at a fraction of the cost. Set up your algo today and enjoy lightning-fast, reliable trading without the high price tag or hassle. Your strategy deserves more - don't let your tech hold you back.

Low latency trading isn't trivial but it's not rocket science either. Latency increases in two primary ways: 1. Physics - the further you are from the exchange, the more latency you accumulate (about 5 microseconds per mile of cable); and 2. Technology - the efficiency of your hardware and software in processing signals.

Many providers focus on just one aspect, leaving you with extra work.

A common issue is when the technology is fast, but the algorithm is physically distant from the exchange, either by geographic separation or by network "hops" through multiple servers. If your vendor's feed handler or risk control resides on a separate machine, you're looking at at least 10 microseconds of added latency-hardly ideal for low-latency trading.

Alternatively, managing your own in-house setup to execute strategies directly with the exchange brings significant monthly costs (colocation fees, market data transmission, system management) plus the need for skilled developers or expensive software vendors.

Is there a better way?

To answer that, we asked ourselves what not to do in order to make Direct Market Access (DMA) as fast as possible while remaining accessible to more firms.

The physics solution is straightforward: algorithms should run on the same machine that connects directly to the exchange, equipped with the best hardware for the job. We eliminate unnecessary separation between you and the matching engine - physics is non-negotiable.

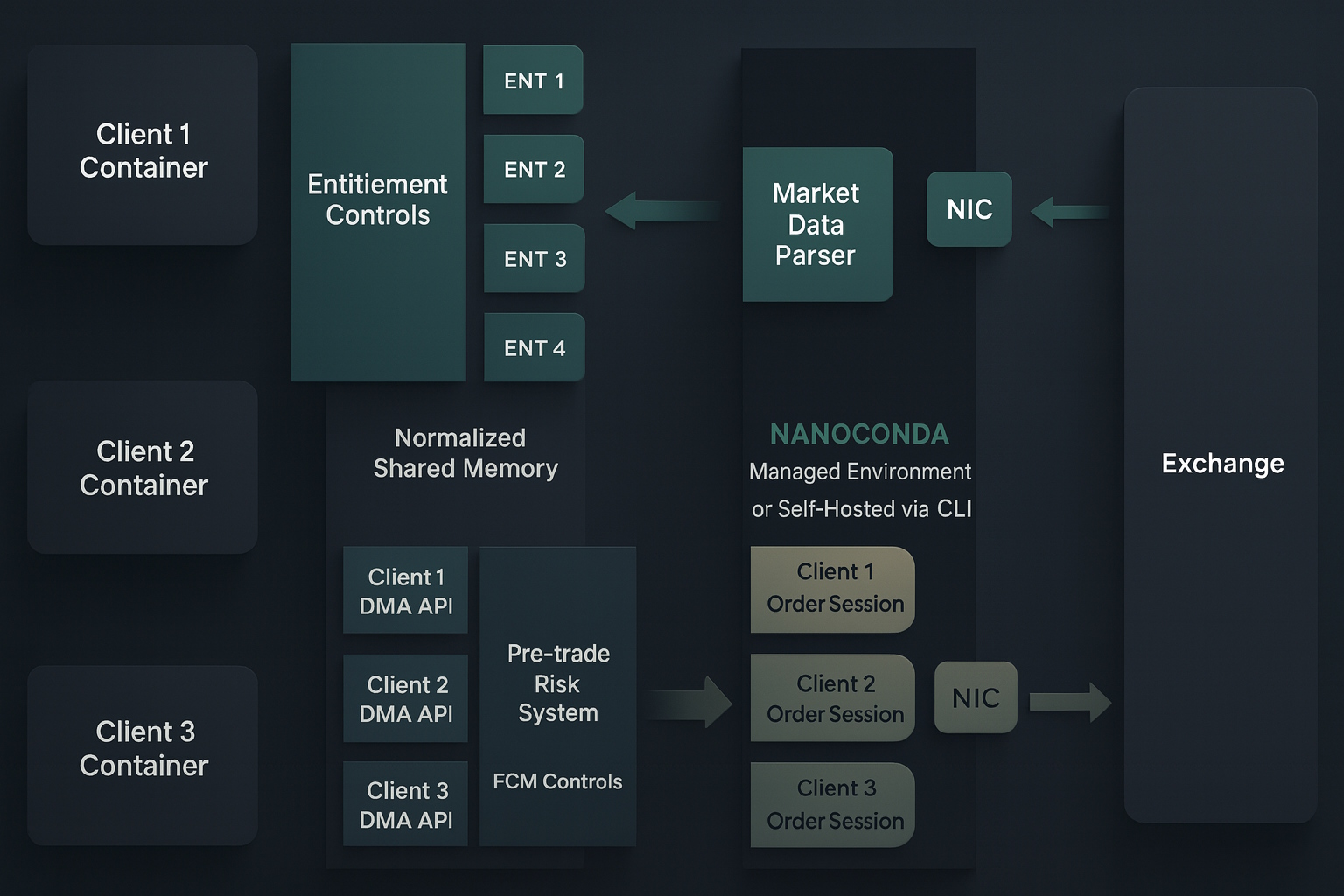

On the technology side, we we focused on three key aspects: 1.Data Processing, 2.Resource Sharing and 3.Cost and Privacy.

Using modern tools and programming techniques, we ensure:

1. The operating system (kernel) is entirely bypassed in critical steps using our proprietary, lock-free, cache-efficient software.

2. Your algorithm has direct access to data and trading in shared memory - no latency from data transmission.

3. You only pay for the resources your algorithm needs, with a secure and isolated environment.

In short, it's common sense, and we apply it.

ISV Connectivity, FCM Integration & Exchange Support

Nanoconda is an Independent Software Vendor (ISV) providing an ultra-low-latency DMA Gateway, Market-Data Feed Handler, and Trading API for professional futures traders.

We support CME-certified iLink 3 order-entry and MDP 3 market-data connectivity, and we integrate seamlessly with any Futures Commission Merchant (FCM) for sponsored access, risk controls, and production deployment.

Our platform delivers institutional-grade performance, end-to-end session management, and sub-microsecond execution for firms seeking a complete, high-performance DMA solution.